Avoltech's Website

Mutual Funds: A look behind their data

Ever wondered what kind of stock investment is done by the most consistent Mutual Funds out there?

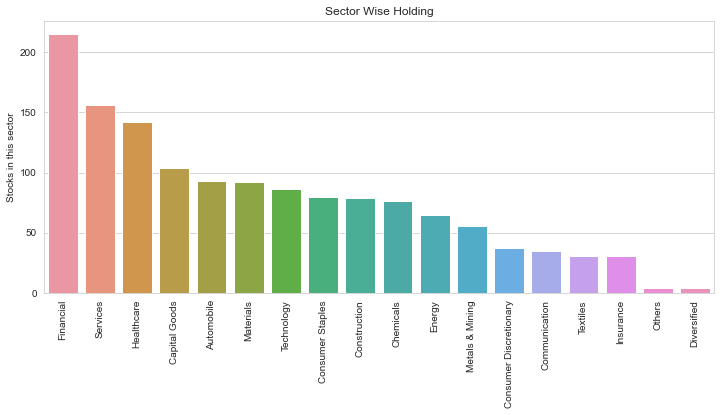

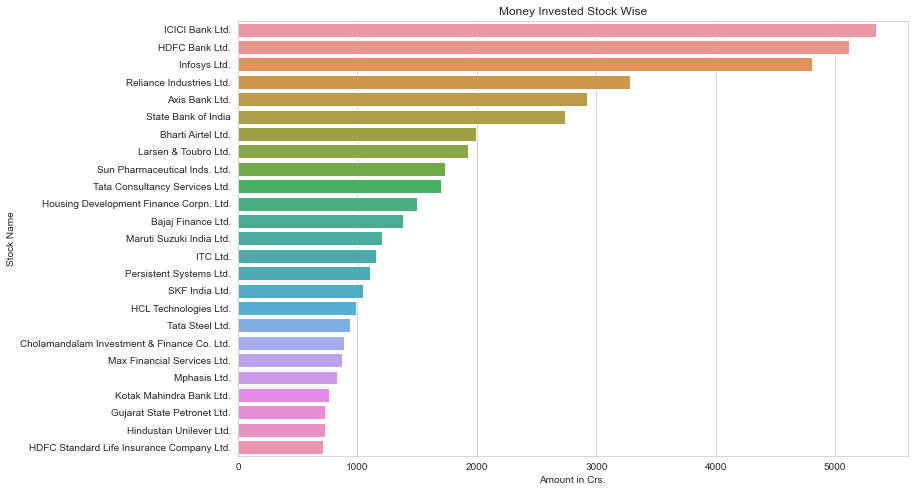

What’s their favourite sector? What’s their favourite stock?

If yes, then I’ve got some answers for you!

Here is a data analysis report for the 27 most consistent Mutual Funds.

# Getting the data:

To answer these questions, we need to get some data.I got the data from https://www.etmoney.com/mutual-funds/all-funds-listing.

After writing a selenium python web scrapping bot I was able to get all the details in a csv file.

(Code for the bot can be found on my github repo mentioned below)

# Cleaning and pre-processing data:

The cleaning part here focuses on getting rid of the unnecessary characters from the numerical fields. That is getting rid of %, , (comma), (spaces), 'Crs'.

Here is a great blog that explains how to work with lists efficiently in pandas. https://towardsdatascience.com/dealing-with-list-values-in-pandas-dataframes-a177e534f173.

# Analysis

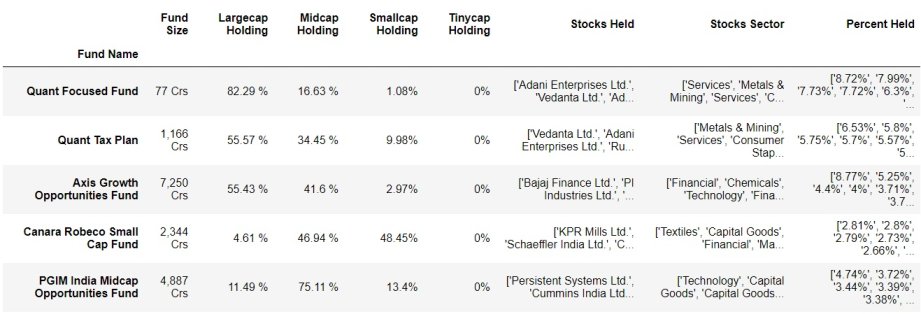

If you want to see all the EDA done on the dataset checkout the IPython notebook on the repo as well.The major insights that I got from it are:

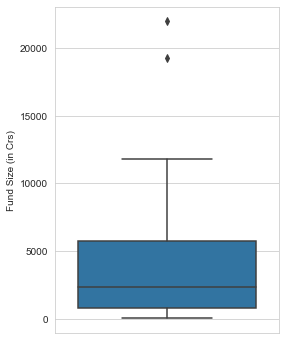

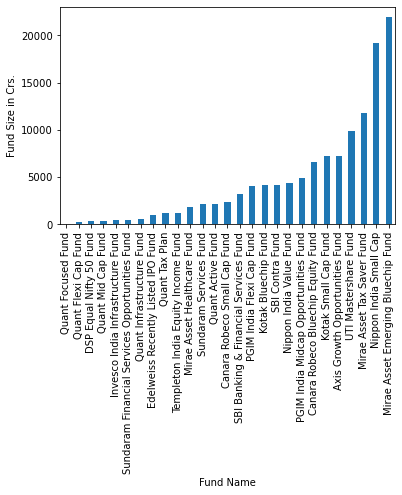

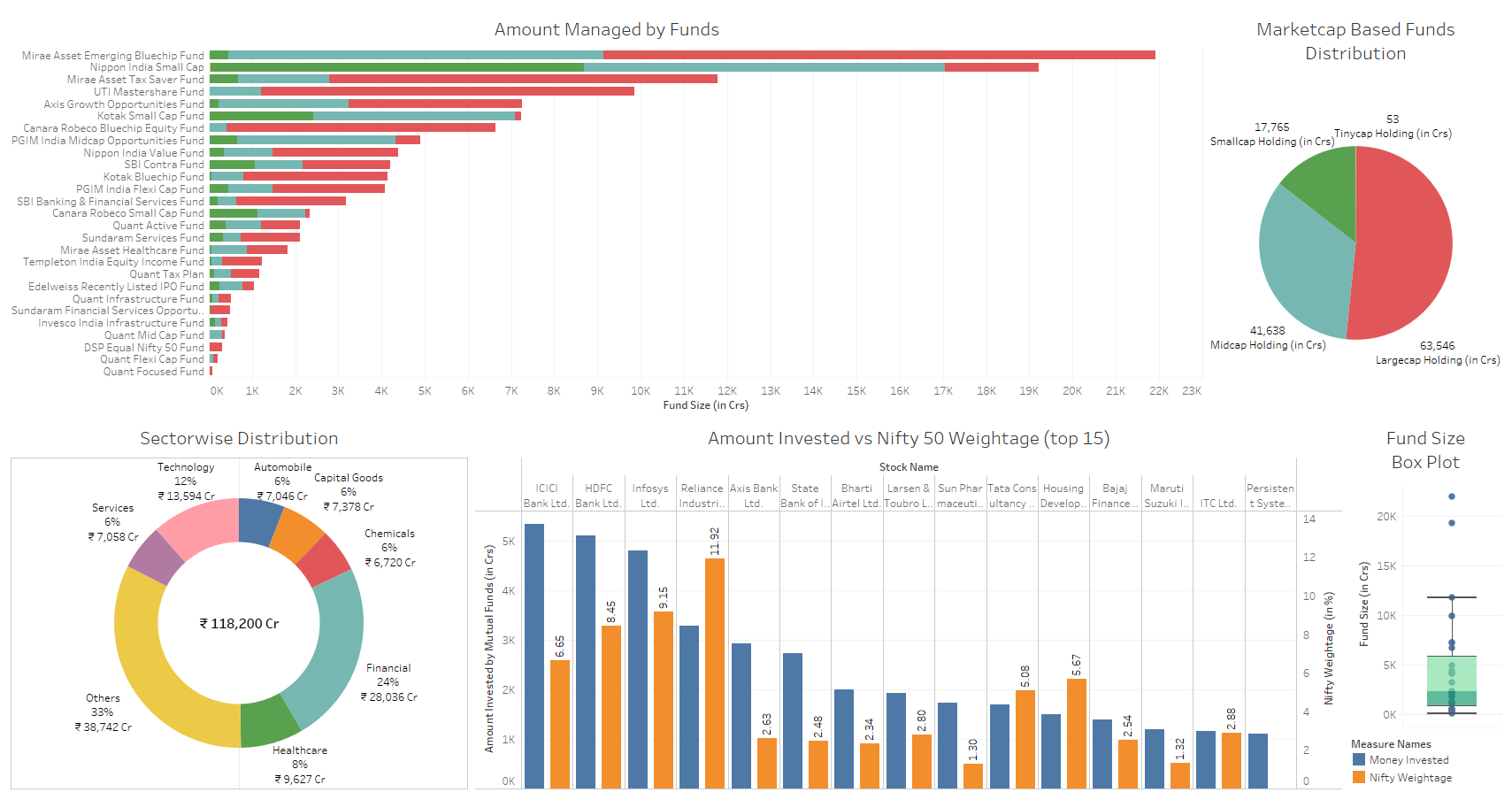

- Most of these funds manage a fund size of about ₹ 700 to 5700 Crores.

- "Mirae Asset Emerging Bluechip Fund" has the biggest funds of all, a whopping 21,000 Crores.

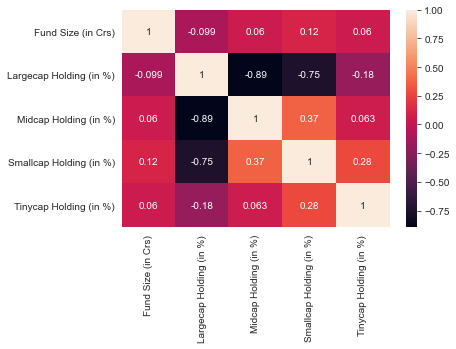

- There is a negative correlation between LargeCap Holding vs MidCap and SmallCap holding.

That means, a fund generally tends to be invested in LargeCap (large companies) or in MidCap and SmallCap (relatively smaller companies - Financial Sector is their favourite sector. 24% of the investment are in financial sector followed by 12% in Technology and 8% in Healthcare.

- ICICI Bank is their favourite stock followed by HDFC Bank, Infosys, and Reliance.

(They have 2.8 times more investment in Infosys than Tata Consultancy Services)

# Dashboard

(View this in desktop mode) https://public.tableau.com/app/profile/abhijeet.kalluray/viz/Mostconsistentmutualfundsanalysis/MutualFundDashboard

These graphs were generated using Tableau.

You can find the code to this project at this GitHub repo: https://github.com/Avoltech/Mutual-Fund-Analysis